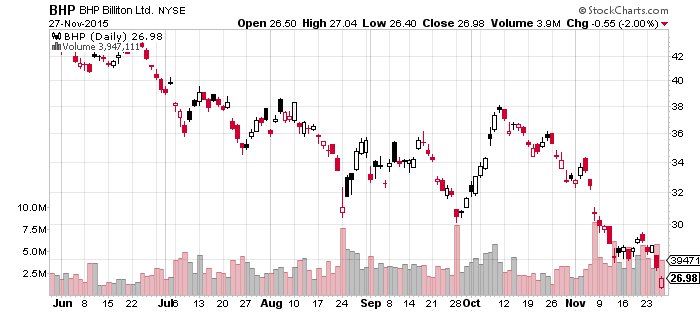

Quelle: stockcharts.com

Quelle: stockcharts.com

Die zwei Branchenschwergewichte durchwandern aktuell eine der schwierigsten Zeiten der kompletten Firmen-Historie und sicher die anspruchsvollste Phase während der letzten 15 Jahre.

Jetzt wurde die erste, erwartete Mega-Klage in Brasilien bekanntgegeben..

Credit to Mining.com:

Brazil sues BHP, Vale for 'initial' $5 billion over spill

Frik Els | November 27, 2015

Screenshot from PigMine 7, via YouTube

Brazil's federal government and two states are suing Samarco, an iron ore miner jointly owned by BHP Billiton and Vale, for $5.3 billion over a catastrophic tailings dam burst that devastated the country's second largest river system, the Rio Doce.

The government attorney general announced the 20 billion real civil damages lawsuit late on Friday, but warned that "the figure is preliminary and could be raised over the judicial process, since the environmental damages of the mud’s arrival at the ocean have not yet been calculated."

The November 5 disaster that killed at least 15 people caused 60 million cubic metres of mine waste from the site in Brazil’s Minas Gerais state to wash downstream into neighbouring state Espírito Santo through remote mountain valleys reaching the Atlantic ocean 600 kilometres awayearlier this week.

Toxic materials, including arsenic, and high levels of lead, aluminum, chromium, nickel and cadmium, were found in the waters of the Rio Doce by a United Nations team and confirmed by Vale on Friday.

Vale and BHP also on Friday announced the establishment of a fund of undisclosed size to help restore the environment. Brazil's environmental watchdog earlier levied a 250 million real ($65 million) fine on Samarco.

More images from Agência Brasil Fotografias

Quote:

BHP Billiton, Vale: Two dozen missing in vast mudflow of Brazil mine disaster

Die jüngsten Kommentare zur Minen-Katastrophe in Brasilien..

Link: http://rohstoffaktien.blogspot.de/2015/11/bhp-billiton-vale-two-dozen-missing-in.html

Screenshot from PigMine 7, via YouTube

Brazil's federal government and two states are suing Samarco, an iron ore miner jointly owned by BHP Billiton and Vale, for $5.3 billion over a catastrophic tailings dam burst that devastated the country's second largest river system, the Rio Doce.

The government attorney general announced the 20 billion real civil damages lawsuit late on Friday, but warned that "the figure is preliminary and could be raised over the judicial process, since the environmental damages of the mud’s arrival at the ocean have not yet been calculated."

The November 5 disaster that killed at least 15 people caused 60 million cubic metres of mine waste from the site in Brazil’s Minas Gerais state to wash downstream into neighbouring state Espírito Santo through remote mountain valleys reaching the Atlantic ocean 600 kilometres awayearlier this week.

Toxic materials, including arsenic, and high levels of lead, aluminum, chromium, nickel and cadmium, were found in the waters of the Rio Doce by a United Nations team and confirmed by Vale on Friday.

Vale and BHP also on Friday announced the establishment of a fund of undisclosed size to help restore the environment. Brazil's environmental watchdog earlier levied a 250 million real ($65 million) fine on Samarco.

More images from Agência Brasil Fotografias

Quote:

BHP Billiton, Vale: Two dozen missing in vast mudflow of Brazil mine disaster

Die jüngsten Kommentare zur Minen-Katastrophe in Brasilien..

Link: http://rohstoffaktien.blogspot.de/2015/11/bhp-billiton-vale-two-dozen-missing-in.html