Quelle:GFMS, SNL, WGC, pilotgold.com

Unabhängiger Blog über interessante Rohstoff-Stories, spannende Wirtschafts-, Politik- und Finanzthemen, das BIG PICTURE, den Kapitalmarkt, aussichtsreiche Investments, aktuelle und brisante Themen + Trends aus der Rohstoff-, Minen- und Energiebranche, sowie über sämtliche Faktoren, die auf den spannenden Rohstoff-Markt Einfluss nehmen. "The more I learn, the more I realize how much I don‘t know." (A.E.) | Always Do Your Own Due Diligence.

Samstag, 15. August 2015

Dienstag, 11. August 2015

Rohstoff-Gigant Rio Tinto verteidigt Kostenführerschaft in der Eisenerz-Sparte

Hierzu ein informativer Beitrag von Mining.com:

GRAPH: Why you can't compete with Rio iron ore

GRAPH: Why you can't compete with Rio iron ore

Frik Els | August 6, 2015

Rio Tinto's Mount Tom Price – a nice little earner since 1966

World number two mining company Rio Tinto (NYSE:RIO) on Wednesday announced a huge slide in profit for the first half of the year with net earnings collapsing by 80%.

Profits dropped from $4.4 billion last year to $806 million in the six months to end-June largely on the back of slump in the price of iron ore.

Revenues dropped by $6.4 billion to $18 billion and underlying earnings for the Anglo-Australian giant came in at $2.9 billion in 2015 – down 43% compared to last year's numbers. Iron ore contributed $2.1 billion of the total.

Iron ore has recovered from a record low of just over $44 hit in July, but is still down more than 20% this year following a 47% fall in 2014.

Rio said iron ore output of 154 million tonnes was 11% higher than last year following a ramp up in production from its core operations in the Pilbara region in West Australia.

Rio hit its targeted annual run rate of 290 million tonnes in May. Iron ore revenues were also hurt by a decline in freight rates of $263 million over the six months.

The Melbourne-based company said cost reductions, favourable exchange rates, volume savings and lower energy costs helped to offset the decline in the iron ore price.

Pilbara cash unit costs were driven down to $16.20 per tonne in H1 2015, compared to $20.40 per tonne during the same period last year and $18.7 in H2 2014. Rio's said it's cut $1 billion of fat from its iron ore business since 2012.

To give an idea of just how reliant Rio has become on the fortunes of iron ore the company calculated that every 10% movement in the price equates to a just over $1 billion impact on its underlying earnings. The same ratio for copper is only $183 million.

Politicians have used the word collusion and some even called for an official anti-trust inquiry into the massive production expansion of the Big 3 – Vale, Rio and BHP.

Competitors have accused the Big 3 of having a tacit agreement to drive down the price and drive out smaller players.

Whether the strategy has been deliberate or not this slide from today's results presentation shows just how difficult it is to go up against with iron ore's top tier and Rio particularly (62% margins for 15 years!).

Rio Tinto's Mount Tom Price – a nice little earner since 1966

World number two mining company Rio Tinto (NYSE:RIO) on Wednesday announced a huge slide in profit for the first half of the year with net earnings collapsing by 80%.

Profits dropped from $4.4 billion last year to $806 million in the six months to end-June largely on the back of slump in the price of iron ore.

Revenues dropped by $6.4 billion to $18 billion and underlying earnings for the Anglo-Australian giant came in at $2.9 billion in 2015 – down 43% compared to last year's numbers. Iron ore contributed $2.1 billion of the total.

Iron ore has recovered from a record low of just over $44 hit in July, but is still down more than 20% this year following a 47% fall in 2014.

Every 10% movement in the iron ore price has a $1 billion impact on Rio's underlying earnings

Rio hit its targeted annual run rate of 290 million tonnes in May. Iron ore revenues were also hurt by a decline in freight rates of $263 million over the six months.

The Melbourne-based company said cost reductions, favourable exchange rates, volume savings and lower energy costs helped to offset the decline in the iron ore price.

Pilbara cash unit costs were driven down to $16.20 per tonne in H1 2015, compared to $20.40 per tonne during the same period last year and $18.7 in H2 2014. Rio's said it's cut $1 billion of fat from its iron ore business since 2012.

To give an idea of just how reliant Rio has become on the fortunes of iron ore the company calculated that every 10% movement in the price equates to a just over $1 billion impact on its underlying earnings. The same ratio for copper is only $183 million.

Politicians have used the word collusion and some even called for an official anti-trust inquiry into the massive production expansion of the Big 3 – Vale, Rio and BHP.

Competitors have accused the Big 3 of having a tacit agreement to drive down the price and drive out smaller players.

Whether the strategy has been deliberate or not this slide from today's results presentation shows just how difficult it is to go up against with iron ore's top tier and Rio particularly (62% margins for 15 years!).

Quelle: http://www.mining.com/graph-why-you-cant-compete-with-rio-iron-ore/

Quelle: mining.com, WoodMac

Quelle: stockcharts.com

Labels:

BHP Billiton,

Big 3,

Big Player,

Branchengiganten,

Eisenerz,

Eisenerzpreis,

Industriemetalle,

Kostenführerschaft,

Marktführer,

Minenaktien,

Minenkonzerne,

RIO,

Rio Tinto,

Rohstoffaktien,

Rohstoffe,

Vale

Medallion Resources beauftragt Vermittlungsexperten für Monazitsand-Akquisitionen

Medaillon Resources (TSX-V:MDL) vollzieht langsam aber sicher eine Wende zum neuen Business Modell im Sektor der "Seltenen Erden". Letzte Woche erfolgte ein weiterer, wichtiger Schritt:

Don Lay, CEO of Medallion Resources Talks Rare Earth Prices

Medallion Appoints Agent to Source South-East Asian Monazite

Posted by Medallion - - 2015 News Release, All News Releases

Medallion Appoints Agent to Source South-East Asian Monazite

Vancouver, BC – Medallion Resources Ltd. (TSX-V: MDL; OTC: MLLOF – “Medallion” or the “Company”), today announced that it has appointed GHC Minerals Ptd. Ltd. (“GHC”) of Perth, Australia to source monazite sand concentrates from suppliers in South-East Asia. GHC is now actively working on the logistical and contractual issues required for the delivery of large sample lots and later commercial-scale shipments from regional mineral-sands suppliers.

Monazite is a rare-earth phosphate mineral available as a by-product of heavy-mineral-sands mining operations. Medallion intends to construct and operate a North American-based monazite processing facility, by importing and processing available monazite feedstock ores, to extract and market high-quality, mixed rare-earth chemical concentrates.

“Medallion is working with a variety of potential suppliers, and although the large heavy-mineral-sands producers are best for long-term supplies, we believe it’s possible to secure additional monazite quantities of approximately 3,000 to 4,000 tonnes per year from South-East Asia. GHC is working with regional producers and traders on our behalf for shipping and contracts,” said Don Lay, Medallion’s President & CEO. “We’ve already tested some monazite samples provided by GHC and they’re of good quality.”

The five-year agreement with GHC provides for certain exclusivity rights to both GHC and Medallion. GHC’s compensation is based on the purchase by Medallion of contracted and accepted monazite supplies of consistent purity, quality and consistency for delivery to Medallion’s proposed North American plant..

Hier zur aktuellen Firmen-Präsentation: http://media.medallionresources.com/wp-content/uploads/2015/07/Q3_2015_Investor_Presentation-Web.pdf

Quelle: medallionresources.com

Quote:

Wenn Hindenburg-Omen verhängnisvoll sind

Informativer Beitrag - credit to Zerohedge:

When Hindenburg Omens Are Ominous

Submitted by Tyler Durden on 08/09/2015 21:20 -0400

I’ve frequently noted that Hindenburg “Omens” in their commonly presented form (NYSE new highs and new lows both greater than 2.5% of issues traded) appear so frequently that they have very little practical use, especially when they occur as single instances. While a large number of simultaneous new highs and new lows is indicative of some amount of internal dispersion across individual stocks, this situation often occurs in markets that have been somewhat range-bound..

Quelle: zerohedge.com

Quelle: zerohedge.com

Barrick Gold rüstet sich für einen Goldpreis von 900 USD

Der schwer angeschlagene, weltgrößte Goldproduzent setzt alle Hebel in Bewegung, um auch bei einem Goldpreis von 900 USD überleben zu können - zumindest temporär. Review - credit to Mining.com:

Barrick making plans for $900 an ounce gold price

John Thornton, chairman of Barrick Gold

UPDATE: Barrick comments on planning for $900 gold price

Shares of Barrick Gold Corporation (NYSE:ABX)(TSX:ABX) slid further after hours after falling nearly 4% in regular trading on Wednesday after the gold miner, the world's largest in terms of output, cut its dividend by 60% despite reporting a narrower second quarter loss.

Barrick's market value is down 50% over the last three months and is now worth some $8 billion in New York. That compares to a $64 billion capitalization when gold was at $1,900 in 2011.

Shares of Barrick Gold Corporation (NYSE:ABX)(TSX:ABX) slid further after hours after falling nearly 4% in regular trading on Wednesday after the gold miner, the world's largest in terms of output, cut its dividend by 60% despite reporting a narrower second quarter loss.

Barrick's market value is down 50% over the last three months and is now worth some $8 billion in New York. That compares to a $64 billion capitalization when gold was at $1,900 in 2011.

Barrick cuts its gold production forecast to between 6.1m – 6.4m ounces as it disposes of assets including 50% of its Zaldivar copper mine in Chile for $1 billion, the Cowal mine in Australia for $550 million in cash and $298 million for its Porgera mine to tackle its crippling debt-load of more than $13 billion.

The company announced additional disposals on Wednesday announcing that in the next few weeks, it will start a process to sell its Bald Mountain, Round Mountain, Spring Valley, Ruby Hill, Hilltop and Golden Sunlight assets in Nevada and Montana.

Other notable features of the quarter and outlook include further cost and capex cuts, but the $250 million debt reduction is some way off Mr Thornton's target of $3 billion in 2015.

- Company reported a net loss of $9 million ($0.01 per share) in the second quarter; adjusted net earnings were $60 million($0.05 per share).

- Free cash flow was $26 million and operating cash flow was $525 million.

- Production in the second quarter was 1.45 million ounces of gold at all-in sustaining costs (AISC) of $895 per ounce.

- Full-year gold production is now expected to be 6.1-6.4 million ounces, reflecting the impact of asset sales.

- All-in sustaining cost guidance for 2015 has been reduced to $840-$880 per ounce.

- Total debt reduced by approximately $250 million in first half.

- $2.45 billion in asset sales and joint ventures announced to date.

- Targeting $2 billion in reduced expenditures across the company by the end of 2016.

- Capital and other expenditures reduced by $240 million in the second quarter.

- Lowered quarterly dividend to two cents per share.

- Scenario planning completed for gold prices down to $900 per ounce.

- On track to achieve approximately $50 million in G&A cost savings in 2015, exceeding original $30 million target for the year. Targeting $90 million in annualized savings in 2016, up from original target of $70 million.

- Completed Preliminary Economic Assessments on projects with the potential to significantly extend mine life at Lagunas Norte and Pueblo Viejo.

The scenario planning for a $200 an ounce fall in the price of gold include even more divestments and these strategies:

- Adjust life-of-mine plans to maximize short-term free cash flow

- Place higher-cost operations on temporary care and maintenance

- Defer stripping activities

- Close or divest mines that do not meet capital allocation objectives

- Increase cut-off grades

- Reduce mining/processing rates

- Further reduce G&A and exploration

- Further reduce sustaining capital

- Process higher-grade stockpiles

Quelle: stockcharts.com

Labels:

ABX,

Barrick Gold,

Belastungsfaktoren,

GDX,

Gold,

Goldaktien,

Goldminen,

Goldpreis,

Goldproduzenten,

Herausforderungen,

Historie,

HUI,

Krise,

Minenaktien,

Pläne,

Schulden,

Strategie,

XAU

Die nächste Krise, die (mal wieder) niemand kommen sah

Must Read - credit to TwoMinds Blog:

Here Comes The Next Crisis "Nobody Saw Coming"

Submitted by Tyler Durden on 08/07/2015 23:12 -0400

When borrowing become prohibitive (or impossible) and raising taxes no longer generates more revenues, state and local governments will have to cut expenditures.

Strangely enough, every easily foreseeable financial crisis is presented in the mainstream media as one that "nobody saw coming." No doubt the crisis visible in these three charts will also fall into the "nobody saw it coming" category.

Take a look at this chart of state and local government debt. As we noted yesterday, nominal GDP rose about 77% since 2000. So state and local debt rose at double the rate of GDP. That is the definition of an unsustainable trend..

..

Quelle: FRED / Zerohedge

Quelle: FRED / Zerohedge

Quelle: FRED / Zerohedge

Quelle: FRED / Zerohedge

Labels:

Aktienmarkt,

Big Picture,

Financial,

Finanzsystem,

GDP,

Historie,

Kredit,

Krise,

Probleme,

Psychologie,

Regierung,

Rezession,

Schulden,

Spannungen,

Staat,

System,

Unternehmen,

USA,

Verbindlichkeiten,

Verschuldung

Montag, 10. August 2015

USA im Schuldensumpf: Entwicklung der gesamten Kredit-Menge vs. Bruttoinlandsprodukt (GDP)

Schulden über Schulden, doch immer weniger reale Auswirkung auf das Wirtschaftswachstum. Hierzu ein sehr brisanter Chart - credit to Zerohedge und FRED:

Quelle: zerohedge.com, FRED

Quote:

The Rich, The Poor, & The Trouble With Socialism

Submitted by Tyler Durden on 08/09/2015 22:05 -0400

Rich Man, Poor Man

Poverty is better than wealth in one crucial way: The poor are still under the illusion that money can make them happy. People with money already know better. But they are reluctant to say anything for fear that the admiration they get for being wealthy would turn to contempt.

“You mean you’ve got all that moolah and you’re no happier than me?”

“That’s right, man.”

“You poor S.O.B.”

We bring this up because it is at the heart of government’s scam – the notion that it can make poor people happier. In the simplest form, government says to the masses: Hey, we’ll take away the rich guys’ money and give it to you. This has two major benefits (from an electoral point of view). First, and most obvious, it offers money for votes. Second, it offers something more important: status.

...and ending up moping.

Labels:

Arm/Reich,

Big Picture,

BIP,

Brisanz,

Divergenz,

FED,

Financial,

GDP,

Herausforderungen,

Kredit,

Kreditmarkt,

Probleme,

Rich and Poor,

Schulden,

Schuldenkrise,

Sozialismus,

Spannungen,

Staatsschulden,

USA,

Verschuldung

Gold: Die geheime "Hoarding Strategy" von China und Russland

Hierzu ein aktueller Beitrag von MoneyMetals, featured by Zerohedge:

China's Secret Gold Hoarding Strategy

Submitted by Tyler Durden on 08/08/2015 14:00 -0400

- Central Banks

- China

- Copper

- Crude

- Crude Oil

- Federal Reserve

- International Monetary Fund

- Mandarin

- Precious Metals

- Reuters

- Volatility

- Yuan

China’s recent stock market gyrations have some analysts now calling China the biggest bubble in history. But those who write off China because of market volatility are missing a more important long-term trend of Chinese geopolitical and monetary ascendancy. That trend shows no signs of abating.

China’s leaders have a clever strategy, and Western financial powers may someday wake up in shock when they realize what has occurred.

It’s true that the Chinese government has helped fuel artificial demand for property and equities. China skeptics who argue that these artificially inflated markets will crash to much lower levels could well prove to be correct. Some China doubters also argue that a downturn in China’s economy will put downward pressure on commodity prices.

Commodities – from crude oil to copper to gold and silver – have already suffered a severe cyclical downturn. Commodity markets tend to be leading indicators, moving in advance of whatever economic story of the day the financial media are telling.

But single-day drawdowns of more than 8% in the Chinese stock market this summer certainly caused some forced liquidations of precious metals positions.

The very fact that booms and busts in China’s markets and economy can now exert heavy influence in globally traded markets such as commodities proves the point that China’s influence isn’t on the wane. Not by a long shot. Even if China’s double-digit rates of growth in the early 2000s prove fleeting and never return, China’s economy still remains on track to eclipse the U.S. economy in the years ahead as the world’s largest.

China, Russia Are Quietly Emerging as World’s Gold Buyers

Chinese officials aim to ultimately to challenge the America’s standing as the world’s superpower. That’s why they’re forming a strategic alliance with Russia, an adversary of the U.S. That’s why both the Russian and Chinese central banks have quietly emerged as the world’s largest gold buyers..

Labels:

antizyklisch,

BRIC,

China,

Edelmetalle,

Gold,

Goldmarkt,

Goldpreis,

Hard Assets,

langfristig,

physisch,

Russland,

Silber,

Strategie,

strategisch,

Trend,

Währungen,

Westliche Welt,

Yuan

Sonntag, 9. August 2015

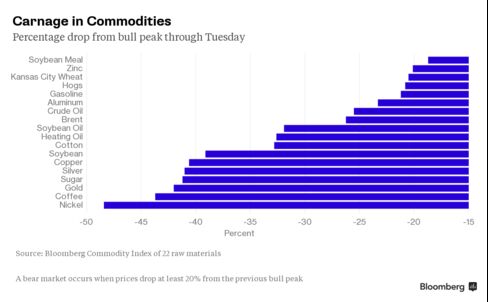

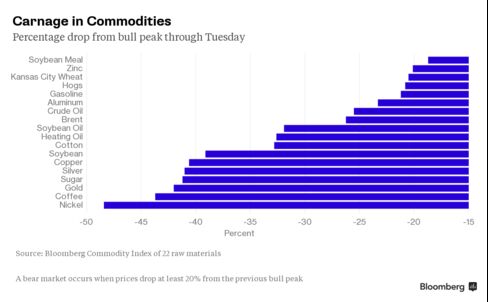

Rohstoffe: Preis-Crash wie zur Zeit der Weltfinanz-Krise in 2008

Es fühlt sich jeden Tag mehr wie 2008 an. Doch die nächste Finanzkrise hat großes Potential die letzte Mega-Krise in den Schatten zu stellen. Zum eklatanten Rohstoffpreis-Crash ein aktueller Beitrag von Bloomberg:

Commodities Are Crashing Like It's 2008 All Over Again

Attention commodities investors: Welcome back to 2008!

The meltdown has pushed as many commodities into bear markets as there were in the month after the collapse of Lehman Brothers Holdings Inc., which spurred the worst financial crisis seven years ago since the Great Depression.

Eighteen of the 22 components in the Bloomberg Commodity Index have dropped at least 20 percent from recent closing highs, meeting the common definition of a bear market. That’s the same number as at the end of October 2008, when deepening financial turmoil sent global markets into a swoon.

A stronger U.S. dollar and China’s cooling economy are adding to pressure on raw materials. Two of the index’s top three weightings -- gold and crude oil -- are in bear markets. The gauge itself has bounced off 13-year lows for the past month.

Four commodities -- corn, natural gas, wheat and cattle -- have managed to stay out of bear markets, due to bad weather and supply issues.

Hedge funds are growing more pessimistic as the year has gone on. Money managers have slashed bets on higher commodity prices by half this year, anticipating lower oil and gold prices..

Quelle: http://www.bloomberg.com/news/articles/2015-08-05/commodities-meltdown-hits-2008-levels-of-bearishness

Commodities Are Crashing Like It's 2008 All Over Again

Attention commodities investors: Welcome back to 2008!

The meltdown has pushed as many commodities into bear markets as there were in the month after the collapse of Lehman Brothers Holdings Inc., which spurred the worst financial crisis seven years ago since the Great Depression.

Eighteen of the 22 components in the Bloomberg Commodity Index have dropped at least 20 percent from recent closing highs, meeting the common definition of a bear market. That’s the same number as at the end of October 2008, when deepening financial turmoil sent global markets into a swoon.

A stronger U.S. dollar and China’s cooling economy are adding to pressure on raw materials. Two of the index’s top three weightings -- gold and crude oil -- are in bear markets. The gauge itself has bounced off 13-year lows for the past month.

Four commodities -- corn, natural gas, wheat and cattle -- have managed to stay out of bear markets, due to bad weather and supply issues.

Hedge funds are growing more pessimistic as the year has gone on. Money managers have slashed bets on higher commodity prices by half this year, anticipating lower oil and gold prices..

Quelle: http://www.bloomberg.com/news/articles/2015-08-05/commodities-meltdown-hits-2008-levels-of-bearishness

Labels:

2008,

Agrar,

Bärenmarkt,

Edelmetalle,

Energie,

Finanzkrise,

Gold,

Historie,

Industriemetalle,

Kupfer,

Öl,

Parallelen,

Rohstoffe,

Rohstoffpreise,

Silber,

Vergleich

Rick Rule, Sprott-Stansberry Symposium: "Dramatische Recovery" im Mining- und Junior-Sektor nur eine Frage der Zeit

Rick Rule's angepriesener "Capitulation moment" ist jetzt auf jeden Fall da.

Im Juli 2015 gab es bspw. die heftigste Kapitulationsphase bei den Goldminen seit Herbst 2008. Einen historischen Sell-Off gab es ebenfalls bei Kupfer- und Silberminen, sowie im Junior Mining Sektor generell.

Hierzu der aktuelle Beitrag von Sprott's Thoughts:

A Recovery "Is Going to Happen" -- Rick Rule at the Sprott-Stansberry Symposium

By Henry Bonner (hbonner@sprottglobal.com)

Is this what a market turn feels like?

“Great opportunities in natural resources occur once per decade,” Rick Rule explained at the Symposium. “They occur at the bottom of a ‘bear market.’

“And this ‘bear market’ is the most severe that I have seen since the mid 1980's. That suggests a very dramatic recovery.”

Despite a down market, our Natural Resource Symposium garnered big numbers. Around 800 people showed, including attendees, exhibitors, and speakers.

The audience was far from gloomy too. In previous years, and at other conferences, attendees have lamented a poor sector. Not here.

From speakers and attendees alike, we saw optimism for natural resources. Some were on the sidelines, waiting for more bottoming for their chance to get in. Others were heavily invested already.

Where are gold and other natural resources headed now?

Speakers were divided. Some believed that a bottom was in, or at least that the sector was cheap enough today.

Others favored sitting it out for now, waiting for a recovery to “announce itself.”

Sprott US Chairman Rick Rule hasn’t given up on natural resources. “A recovery is inevitable,” he said.

Rick revealed that he was still holding “lots of cash” to prepare for future buying opportunities during a major dip.

Agora founder and self-proclaimed “rogue economist” Bill Bonner advocated for owning gold regardless of the price. We’ve been living in a “zombie boom” for the last 40 years, he told the audience. During that time, the “takers” and cronies have gained increasing control over the US economy.

The economy has managed to grow anyway, sparing regular folks too much pain, thanks to the bull market in bonds that has occurred over the same timeframe. But this can’t last forever. As he wrote in Financial Reckoning Day and Empire of Debt, a collapse will occur eventually. “You’ll want to own gold as insurance for your portfolio,” he says.

Steve Sjuggerud of Stansberry’s True Wealth has a more upbeat take on the zombie boom: It will go on for a few more years, so you can still make money in stocks and real-estate.

He wasn’t ready to make a major play in natural resources, he said. “They’re cheap, they’re hated, but I still want to see an uptrend.”

After he sees an uptrend in resource stocks, Steve will be ready to make a big play in the sector.

Eric Sprott was one of the most-awaited speakers at the conference.

Contrary to other speakers waiting for signs of a turnaround, he isn’t holding back. He told the audience that he’d personally taken ownership of a gold mine, along with other big investments in the sector.

Other big-name speakers included Robert Friedland, Chairman of Ivanhoe Mines. He told the audience they’d be crazy to miss this opportunity.

Copper, zinc, platinum, palladium – these metals are priced for the “end of the world,” as he put it, saying China in particular will be a big consumer of these metals. You need copper for electrical grids, platinum and palladium to purify motor exhaust, and zinc as a crop fertilizer. These are all areas where China may have a need for the metals.

“The mining sector cuts are not just skin deep, they are to the bone,” he said. Miners can’t afford to produce if metals prices go any lower, so if they drop from here, it means the world doesn’t want a supply of these metals, according to Robert.

Even Doug Casey said he was getting heavily into resource stocks now – despite his speech title, Mining Is a Dying, Stupid […] Business.

Did the speakers give any specifics about where they’re looking?

Dan Ferris of Stansberry’s Extreme Value gave his “top pick of the year,” Altius Minerals, a royalty company. The company gets a small cut of many different mining operations’ revenues.

Frank Trotter, co-founder of EverBank told attendees to take a look at “metals-backed CDs.” According to Frank, these can increase in value with metals prices, but contain minimal downside risk.

Of course, the conference also featured over 50 resource companies. As Rick explained, he expects at least some of the companies that were at the Symposium to become high-performers in the next up-move.

Some of the most well-followed names were Kaminak Gold, presented by Eira Thomas, Uranium Energy with Amir Adnani, and Sprott Resource Corp, represented by Steve Yuzpe.

Miles Thompson presented Reservoir Minerals and William Lamb presented the Lundin Group.

Dev Randhawa was also there, representing Fission Uranium and Randy Smallwood presented for Silver Wheaton.

David Harquail told attendees to consider Franco-Nevada, the world’s largest royalty company, as an alternative to a gold ETF. Franco-Nevada offers diversification because it has so many separate royalty contracts, he argued.

The resource sector is cheap right now, but it could offer great rewards to investors who are willing to participate.

As Rick Rule put it, the companies in the sector face a bad reputation. But investors forget that some hard-working, ethical, and talented people are doing “real work.” And the price of participating in their projects, as investors, has often dropped dramatically.

“We’ve had a whole lot of fun at this conference,” Rick concluded, “and we’re going to do it all again next year.”

Didn’t make it to the Symposium? All keynote speeches, except Robert Friedland’s Q&A, are available for replay online, along with select workshops. Click here to order.

Quelle: http://sprottglobal.com/thoughts/

A Recovery "Is Going to Happen" -- Rick Rule at the Sprott-Stansberry Symposium

By Henry Bonner (hbonner@sprottglobal.com)

Is this what a market turn feels like?

“Great opportunities in natural resources occur once per decade,” Rick Rule explained at the Symposium. “They occur at the bottom of a ‘bear market.’

“And this ‘bear market’ is the most severe that I have seen since the mid 1980's. That suggests a very dramatic recovery.”

Despite a down market, our Natural Resource Symposium garnered big numbers. Around 800 people showed, including attendees, exhibitors, and speakers.

The audience was far from gloomy too. In previous years, and at other conferences, attendees have lamented a poor sector. Not here.

From speakers and attendees alike, we saw optimism for natural resources. Some were on the sidelines, waiting for more bottoming for their chance to get in. Others were heavily invested already.

Where are gold and other natural resources headed now?

Speakers were divided. Some believed that a bottom was in, or at least that the sector was cheap enough today.

Others favored sitting it out for now, waiting for a recovery to “announce itself.”

Sprott US Chairman Rick Rule hasn’t given up on natural resources. “A recovery is inevitable,” he said.

Rick revealed that he was still holding “lots of cash” to prepare for future buying opportunities during a major dip.

Agora founder and self-proclaimed “rogue economist” Bill Bonner advocated for owning gold regardless of the price. We’ve been living in a “zombie boom” for the last 40 years, he told the audience. During that time, the “takers” and cronies have gained increasing control over the US economy.

The economy has managed to grow anyway, sparing regular folks too much pain, thanks to the bull market in bonds that has occurred over the same timeframe. But this can’t last forever. As he wrote in Financial Reckoning Day and Empire of Debt, a collapse will occur eventually. “You’ll want to own gold as insurance for your portfolio,” he says.

Steve Sjuggerud of Stansberry’s True Wealth has a more upbeat take on the zombie boom: It will go on for a few more years, so you can still make money in stocks and real-estate.

He wasn’t ready to make a major play in natural resources, he said. “They’re cheap, they’re hated, but I still want to see an uptrend.”

After he sees an uptrend in resource stocks, Steve will be ready to make a big play in the sector.

Eric Sprott was one of the most-awaited speakers at the conference.

Contrary to other speakers waiting for signs of a turnaround, he isn’t holding back. He told the audience that he’d personally taken ownership of a gold mine, along with other big investments in the sector.

Other big-name speakers included Robert Friedland, Chairman of Ivanhoe Mines. He told the audience they’d be crazy to miss this opportunity.

Copper, zinc, platinum, palladium – these metals are priced for the “end of the world,” as he put it, saying China in particular will be a big consumer of these metals. You need copper for electrical grids, platinum and palladium to purify motor exhaust, and zinc as a crop fertilizer. These are all areas where China may have a need for the metals.

“The mining sector cuts are not just skin deep, they are to the bone,” he said. Miners can’t afford to produce if metals prices go any lower, so if they drop from here, it means the world doesn’t want a supply of these metals, according to Robert.

Even Doug Casey said he was getting heavily into resource stocks now – despite his speech title, Mining Is a Dying, Stupid […] Business.

Did the speakers give any specifics about where they’re looking?

Dan Ferris of Stansberry’s Extreme Value gave his “top pick of the year,” Altius Minerals, a royalty company. The company gets a small cut of many different mining operations’ revenues.

Frank Trotter, co-founder of EverBank told attendees to take a look at “metals-backed CDs.” According to Frank, these can increase in value with metals prices, but contain minimal downside risk.

Of course, the conference also featured over 50 resource companies. As Rick explained, he expects at least some of the companies that were at the Symposium to become high-performers in the next up-move.

Some of the most well-followed names were Kaminak Gold, presented by Eira Thomas, Uranium Energy with Amir Adnani, and Sprott Resource Corp, represented by Steve Yuzpe.

Miles Thompson presented Reservoir Minerals and William Lamb presented the Lundin Group.

Dev Randhawa was also there, representing Fission Uranium and Randy Smallwood presented for Silver Wheaton.

David Harquail told attendees to consider Franco-Nevada, the world’s largest royalty company, as an alternative to a gold ETF. Franco-Nevada offers diversification because it has so many separate royalty contracts, he argued.

The resource sector is cheap right now, but it could offer great rewards to investors who are willing to participate.

As Rick Rule put it, the companies in the sector face a bad reputation. But investors forget that some hard-working, ethical, and talented people are doing “real work.” And the price of participating in their projects, as investors, has often dropped dramatically.

“We’ve had a whole lot of fun at this conference,” Rick concluded, “and we’re going to do it all again next year.”

Didn’t make it to the Symposium? All keynote speeches, except Robert Friedland’s Q&A, are available for replay online, along with select workshops. Click here to order.

Quelle: http://sprottglobal.com/thoughts/

Quelle: http://www.naturalresourcesymposium.com

Labels:

Bärenmarkt,

Einschätzung,

Goldaktien,

Goldminen,

Historie,

Junior Mining,

Kapitulation,

Kupferminen,

Minen,

Minenaktien,

Rick Rule,

Silberminen,

Sprott,

Sprott Stansberry Natural Resources Symposium,

Stansberry

Abonnieren

Kommentare (Atom)