Commodities Are Crashing Like It's 2008 All Over Again

Attention commodities investors: Welcome back to 2008!

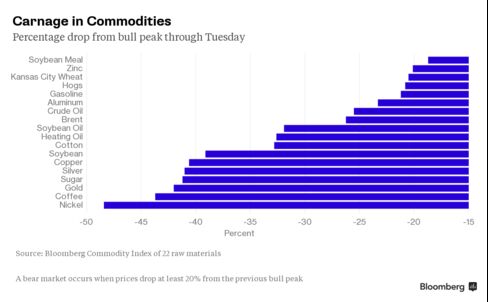

The meltdown has pushed as many commodities into bear markets as there were in the month after the collapse of Lehman Brothers Holdings Inc., which spurred the worst financial crisis seven years ago since the Great Depression.

Eighteen of the 22 components in the Bloomberg Commodity Index have dropped at least 20 percent from recent closing highs, meeting the common definition of a bear market. That’s the same number as at the end of October 2008, when deepening financial turmoil sent global markets into a swoon.

A stronger U.S. dollar and China’s cooling economy are adding to pressure on raw materials. Two of the index’s top three weightings -- gold and crude oil -- are in bear markets. The gauge itself has bounced off 13-year lows for the past month.

Four commodities -- corn, natural gas, wheat and cattle -- have managed to stay out of bear markets, due to bad weather and supply issues.

Hedge funds are growing more pessimistic as the year has gone on. Money managers have slashed bets on higher commodity prices by half this year, anticipating lower oil and gold prices..

Quelle: http://www.bloomberg.com/news/articles/2015-08-05/commodities-meltdown-hits-2008-levels-of-bearishness

Keine Kommentare:

Kommentar veröffentlichen