Goldcorp CEO

frustrated by reaction to Cerro Negro writeoff

Carl

Surran, SA News Editor

- Goldcorp (NYSE:GG) fell 8.4% today after missing

Q4 earnings expectations and posting a huge impairment charge

on one of its newest mines, which CEO Chuck Jeannes called

"frustrating."

- In today's earnings conference call, the CEO said

analysts seemed to expect sales from the Cerro Negro mine and another mine

to be included in this quarter’s results, even though he had told them it

would not happen.

- Jeannes said he is still positive about Cerro Negro

despite the writedown, which came because of high inflation and import and

currency restrictions in Argentina; the country has recovered from the

sort of crisis it is now experiencing before, he said.

- Despite the disappointing report, analysts remain largely positive on the stock; a BMO analyst today described GG as "the preferred senior gold stock, offering strong production growth, reasonable balance sheet and healthy dividend yield."

Goldcorp misses

on Q4 earnings, takes $2.3B writedown on Argentina mine

Carl

Surran, SA News Editor

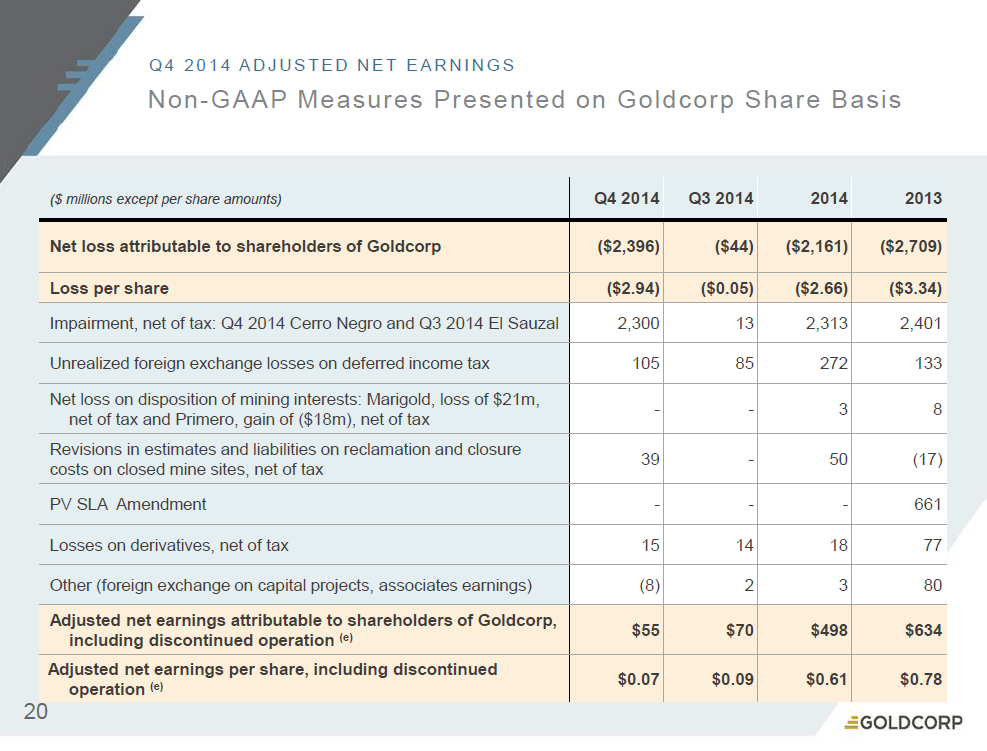

- Goldcorp missed Q4

earnings and revenue expectations, as lower

prices and higher costs offset a big jump in production.

- GG's unadjusted $2.4B loss in Q4 was mostly

attributable to a $2.3B writedown on its Cerro Negro gold mine in

Argentina, which achieved commercial production just

after the end of Q4; GG previously had warned it could take a

charge of up to $2.7B on the project.

- Q4 gold production totaled a record 890.9K oz., up from

768.9K oz. in the year-ago period, but all-in sustaining costs were much

higher at $1,035/oz. from $810/oz. a year earlier.

- GG forecasts 2015 production to rise ~20% Y/Y to

3.3M-3.6M oz. and all-in sustaining costs of $875-$950/oz.; plans capital

spending for the year at $1.2B-$1.4B.

- GG expects major contributions from its new operations

at Cerro Negro, Eleonore and Cochenour (still in development); Eleonore

reached production in October but produced only 18.3K oz. due to issues

with a tailings filter press system that the company says have been

resolved.

- Also announced proven and probable mineral reserves of 49.6M oz. of gold and 789M oz. of silver.

Quelle: goldcorp.com

Quelle: goldcorp.com

Quelle: goldcorp.com

Quelle: goldcorp.com

Quelle: bigcharts.com

Quelle: bigcharts.com

Keine Kommentare:

Kommentar veröffentlichen