China Buys 45t Of Gold Ahead Of Golden Week

Published: 05-10-2014 02:23

The National Day Golden Week, a one week holiday in China mainland, yes, the Chinese name their holidays golden, began on October 1 this year, so that's when trading stopped on the Shanghai Gold Exchange (SGE) and Shanghai Futures Exchange (SHFE). This means I only have half a story for you today.

The latest withdrawal data from the SGE always lags one week and is thus from week 39 (September 22- 26), other data from the SGE and SHFE covers week 40, which in this case covers only 2 days (September 29 - 30).

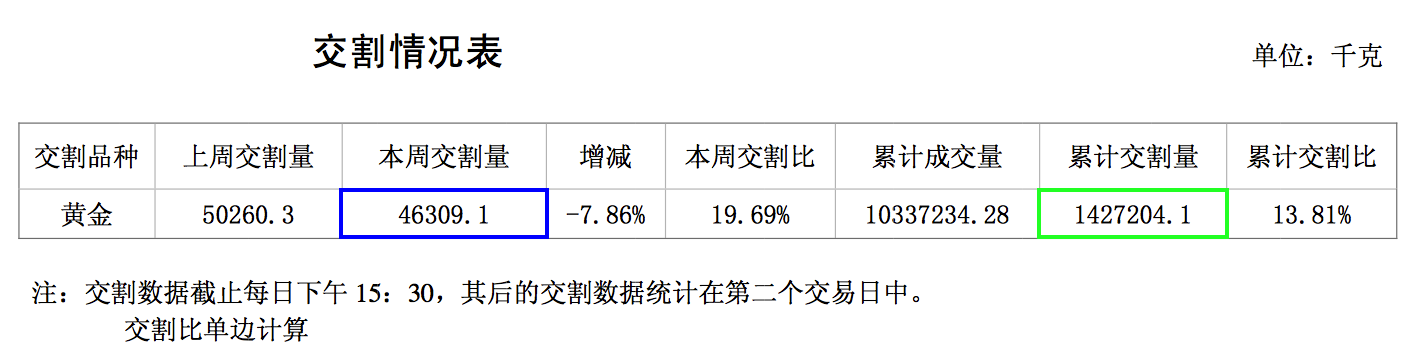

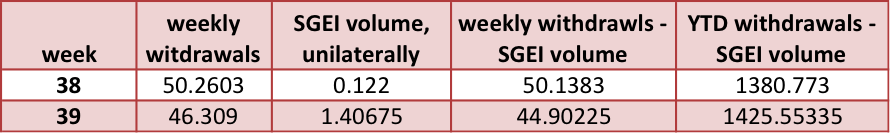

Let's begin with the SGE. In week 39 (September 22 - 26) the amount of gold withdrawn from the SGE vaults accounted for 46 tonnes. Quite a strong week if one bears in mind this number equals wholesale demand of gold in China mainland. Year to date 1427 tonnes have been withdrawn from the SGE vaults.

Blue is weekly withdrawals in Kg's, green is withdrawals year to date in Kg's.

BUT, as I mentioned last week, since the launch of the the Shanghai International Gold Exchange (SGEI) the SGE discloses withdrawal numbers from the mainland added with those from the SGEI in the Shanghai FTZ. Several kind requests from my side to the SGE to disclose the numbers separately haven't been heard as of yet. And so, we must deduct all trading volume on the SGEI from SGE withdrawal numbers as the SGEI trades couldhave been withdrawn from the International Board (FTZ) vaults. (if you're of the opinion I'm talking jibberish, consider reading this introduction about the SGE and SGEI)

Until the SGE will disclose withdrawals numbers separate I'm forced to adjust my numbers and charts.

The SGEI was launched in week 38. From then on I will subtract all SGEI trades, single-sided, from withdrawal numbers as, though we don't know for sure, the SGEI buyers could have opted for withdrawal in the Shanghai FTZ.

If the SGE will not separate withdrawal numbers - from the mainland (SGE) and from the Shanghai FTZ (SGEI) - our view on Chinese wholesale demand will be increasingly distorted when time passes (!). I will give the SGE another call and explain the necessity of this matter and kindly ask again if they want to separate withdrawal numbers henceforth. Who knows...

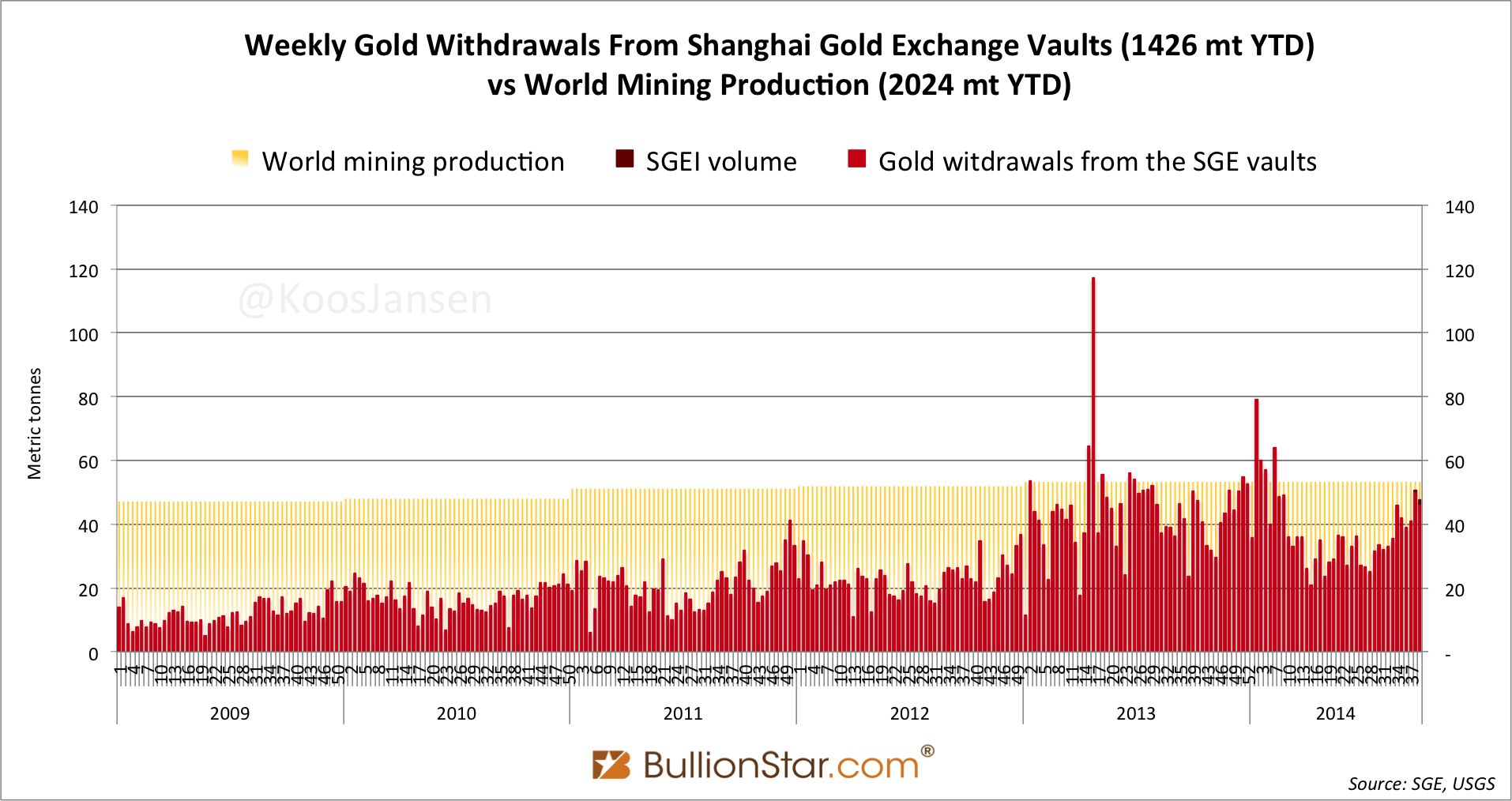

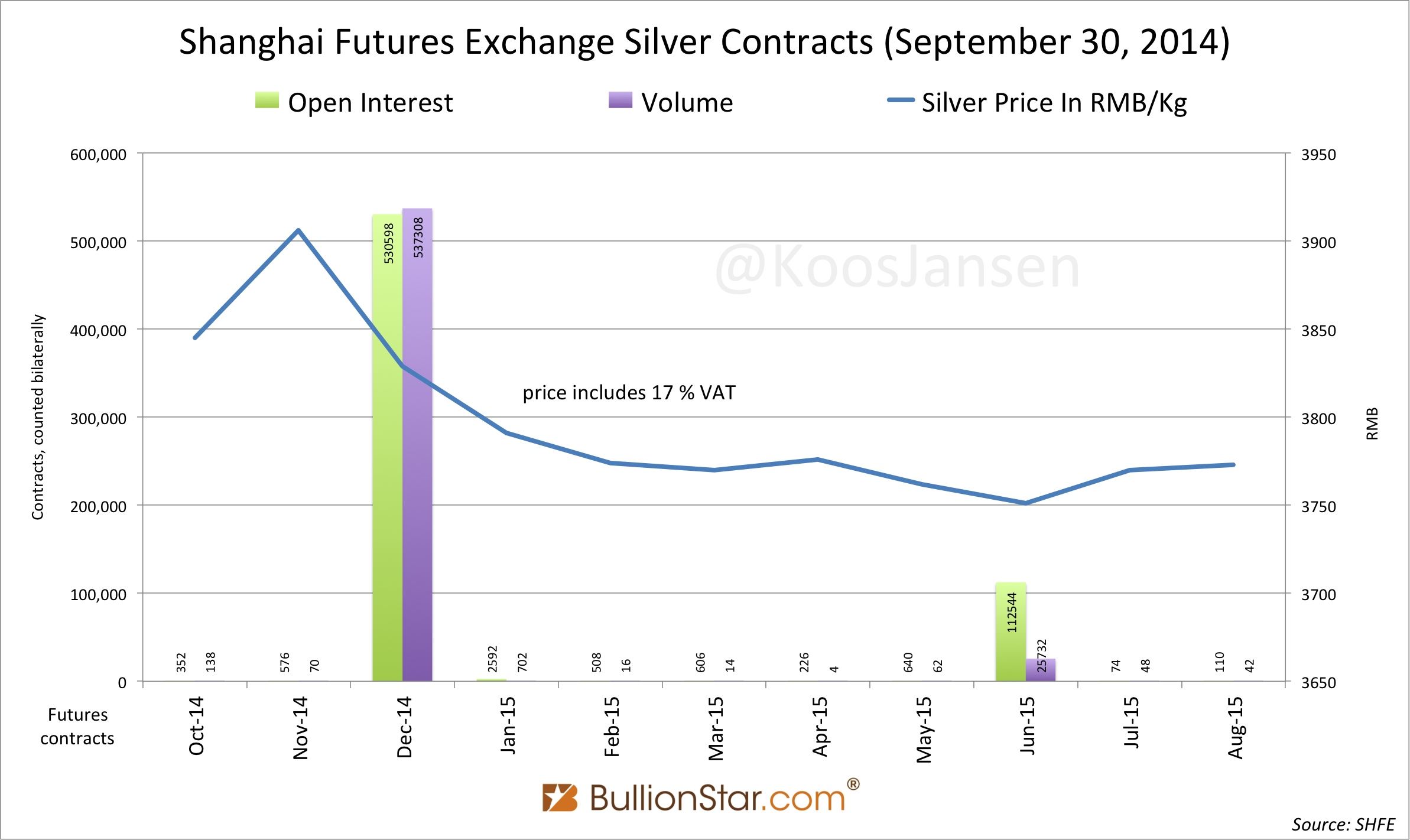

Last but not least let's have a look at what happened in the Chinese silver market on the last trading days (September 29, 30). Silver on the SHFE is still trading in backwardation - since August 6.

SHFE inventory increased by 18 % w/w to 94.9 tonnes! My guess is as long as the futures curve is in backwardation or won't turn to steep contango, inventory will remain around current levels. Inventory will increase if a steep contango curve pays to cash and carry the metal, or if the open interest rises significantly.

The price of deferred silver in Shanghai excluding 17 % VAT traded at a discount of just under 4 % relative to London spot. Shanghai silver remains scarce.

Koos Jansen

Copyright information: BullionStar permits you to copy and publicize blog posts or quotes and charts from blog posts provided that a link to the blog post's URL or to https://www.bullionstar.com is included in your introduction of the blog post together with the name BullionStar. The link must be taret="_blank" without rel="nofollow". All other rights are reserved. BullionStar reserves the right to withdraw the permission to copy content for any or all websites at any time.

Keine Kommentare:

Kommentar veröffentlichen