The Weekly Dig

Haywood Mining Team

Investors Sceptical on Copper as Red Metal Hits $2.20/lb

While the Federal Reserve announced its decision to hold interest rates (as expected) given continued weak economic data out of the U.S., the price of copper has defied the bears in September, rising from just above $2.00 per pound on September 1 through the $2.20 per pound level on Friday. Many commentators remain unconvinced that better times are ahead for copper, with the red metal commonly viewed as a useful guide to the state of the global economy. Certainly the Federal Reserve’s decision to hold rates could be seen as supporting this view, although some would view the Feds decision to keep interest rates on hold as more to do with timing given the impending U.S. election; in a statement released on Wednesday the Federal Reserve hinted at a possible rate hike this year, most likely in December, which may provide upward momentum for copper and other base metals in the medium term.

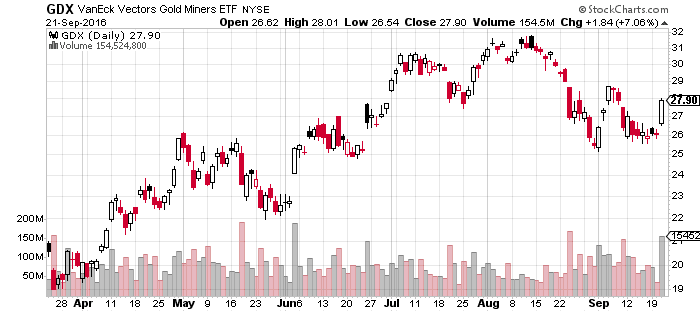

Meanwhile, after testing the $1,300 per ounce level last week, the Feds decision saw the price of gold rise 2% following the announcement before finishing at $1,338 per ounce on Friday. Gold equities followed suit, with the S&P/TSX Global Gold Index rising 4% to finish at 64.9 on Friday. Silver (↑5%), platinum (↑3.7%) and palladium (↑4.3%) were all up, finishing at $19.70, $1,055 and $704 per ounce respectively. In base metals, nickel prices surged almost 9% this week, finishing at $4.82 per pound while lead (↓1.4%) and zinc (↑3%) each finished at $0.87 and $1.03 per pound respectively. The price of WTI crude regained some of its recent losses, up 2.6% to finish at $45. Finally, the UxC Weekly Spot Price of uranium was down (↓3.1%) closing at $24.12 per pound on Friday..

Quelle: stockcharts.com

Quelle: stockcharts.com