Hierzu ein Top-Artikel von

Frank Holmes'

U.S. Global Investors:

$8 Trillion Alternative Energy Boom Is a Win for Copper

Here’s a bit of energizing news: In 2014, for the first time in four decades, the global economy grew along with energy demand without an increase in global carbon emissions.

That’s according to energy policy group REN21’s just-released Renewables 2015 Global Status Report, which attributes this stabilization to “increased penetration of renewable energy and to improvements in energy efficiency.”

What this means is that as the world’s population continues to grow, and as more people in developing and emerging countries gain access to electricity, the role alternative energy sources such as wind, solar and geothermal play should skyrocket. Between now and 2040, a massive $8 trillion will be spent globally on renewables, about two thirds of all energy spending, according to Bloomberg New Energy Finance. Solar power alone is expected to draw $3.7 trillion.

This is good news indeed for copper, necessary for the conduction of electricity in all energy technologies, whether they be traditional or alternative. The use of some carbon-emitting fossil fuels—coal, for instance—will likely drop off over the years, but copper will remain an irreplaceable component in our ever-expanding energy needs.

Global copper consumption is poised to increase not just because electricity demand is growing. New energy technologies typically require more of the red metal than traditional sources. Each megawatt of wind power capacity, for instance, uses an average of 3.6 tonnes of copper. Electric trolleys, buses and subway cars use about 2,300 pounds of copper apiece. Where we’ll see the most significant growth, though, is in the production of hybrid and electric cars, which use two to three times more copper than internal combustion engines..

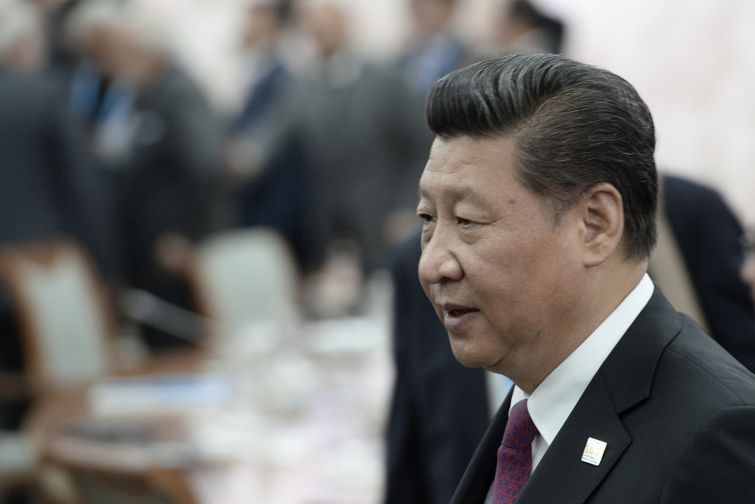

This week Chinese president Xi Jinping showed he wasn't serious about letting the market determine stock prices.Handout/Getty Images

This week Chinese president Xi Jinping showed he wasn't serious about letting the market determine stock prices.Handout/Getty Images