Quelle: bloomberg.com, zerohedge.com

Unabhängiger Blog über interessante Rohstoff-Stories, spannende Wirtschafts-, Politik- und Finanzthemen, das BIG PICTURE, den Kapitalmarkt, aussichtsreiche Investments, aktuelle und brisante Themen + Trends aus der Rohstoff-, Minen- und Energiebranche, sowie über sämtliche Faktoren, die auf den spannenden Rohstoff-Markt Einfluss nehmen. "The more I learn, the more I realize how much I don‘t know." (A.E.) | Always Do Your Own Due Diligence.

Posts mit dem Label GDX werden angezeigt. Alle Posts anzeigen

Posts mit dem Label GDX werden angezeigt. Alle Posts anzeigen

Mittwoch, 16. August 2017

Goldminen-ETF GDX: Short-Interest Quote steigt auf den höchsten Stand seit Februar 2016

Die Wall Street wettet einmal mehr auf den nächsten Crash bei den Goldminen. Erneut ein Kontraindikator?

Freitag, 26. Mai 2017

Goldminen-ETF GDX mit Rekord-Abflüssen

Gestern zogen Investoren an einem Tag so viel Kapital aus dem GDX-ETF ab wie noch nie zuvor:

Quelle: bloomberg.com

Labels:

Abflüsse,

Agnico Eagle Mines,

Barrick Gold,

ETF,

ETP,

Franco-Nevada,

GDX,

Gold,

Goldaktien,

Goldcorp,

Goldminen,

Investoren,

Kinross Gold,

Newmont Mining,

Randgold Resources,

Sibanye Gold,

Wheaton Precious Metals

Montag, 24. April 2017

Goldminen: Underperformance der Juniors gegenüber der Majors

Hierbei spielen die erheblichen Verwerfungen im führenden Junior-Goldminen-ETF GDXJ zuletzt sicher eine maßgebliche Rolle (Link):

Quelle: stockcharts.com

Quelle: stockcharts.com

Quelle: stockcharts.com

Labels:

Aktien,

Chart,

Charttechnik,

Equities,

GDX,

GDXJ,

Gold,

Goldaktien,

Goldminen,

Investments,

Junior-Mining,

Juniors,

Majors,

Performance,

Ratio,

Silber,

Silberminen

Donnerstag, 8. Dezember 2016

Gold- & Silberminen, GDX: Fundamental-Kennziffern im 3. Quartal 2016

Informative Übersicht über die Q3-Entwicklung einiger fundamentalen und operativen Kennziffern bei den großen Gold- und Silberproduzenten im GDX - credit to ZealLLC:

Quelle: zealllc.com

Quelle: zealllc.com

Labels:

Agnico Eagle Mines,

AngloGold,

Barrick Gold,

First Majestic Silver,

Franco-Nevada,

Fundamentals,

GDX,

Goldcorp,

Goldminen,

Goldproduzenten,

Newmont Mining,

Randgold Resources,

Silberminen,

Silver Wheaton

Sonntag, 20. November 2016

Hohe Investoren-Nachfrage: Neues Goldminen-ETF startet in Hongkong

Letzten Freitag wurde in der asiatischen Finanzmetropole ein neues Goldminen-ETF gestartet, das die hohe Nachfrage nach Goldminen-Investmentprodukten stillen soll:

FIRST GOLD MINERS ETF LAUNCHES IN HONG KONG

A gold miners exchange traded fund (ETF), a first in Hong Kong, was launched on the Hong Kong Exchange & Clearing (HKEX) today, Friday November 18.

The ETF – known as “XIE Shares FTSE Gold Miners ETF” – invests in a basket of physical equities and replicates the FTSE Gold Mines Net Tax Index, which currently represents 35 global gold mining companies that produce a minimum of 300,000 ounces of gold per year. Some of the countries represented in the ETF include Canada, US, South Africa, and Australia.

The Gold Miners ETF meets increasing investor demand for gold investing in light of a loss in confidence in paper money, caused by the increasing debt of developed countries, said Enhanced Investment Products (EIP), whose ETF business XIE Shares launched the ETF.

This debt, and recent political events such as Brexit and the US elections, point to more volatility and uncertainty in financial markets, and gold provides a hedge against inflation or deflation and is a store of value, EIP said in its statement.

“This new product…will enable retail and institutional investors to capitalise on gold price fluctuations through the ownership of gold mining stocks, which tend to go up and down more than the price of gold, given the size of their gold deposits relative to their market capitalisation. This year, gold mining stocks are outperforming physical gold by approximately 50%,” EIP’s ceo Tobias Bland said.

EIP is a Hong Kong-based investment management firm which was established in 2002. Brokerage and investment group CLSA acquired 49% of the XIE Shares Hong Kong ETF platform in 2014.

Net inflows into exchange traded products (ETP) have helped drive a sharp increase in gold investment demand this year, according to the World Gold Council (WGC).

Total gold investment demand rose 44% year-on-year to 336 tonnes in the third quarter of this year, with ETP inflows accounting for 146 tonnes as investors continued to build up their strategic allocations to gold, the WGC said in its report in November.

The spot gold price has risen around 30% since the beginning of this year to reach as high as $1,375.25 in July. The price has since pared to $1,205 per oz recently on Friday, but is still higher than the low of $1,062.40 reached at the beginning of this year. - See more at:

FIRST GOLD MINERS ETF LAUNCHES IN HONG KONG

A gold miners exchange traded fund (ETF), a first in Hong Kong, was launched on the Hong Kong Exchange & Clearing (HKEX) today, Friday November 18.

The ETF – known as “XIE Shares FTSE Gold Miners ETF” – invests in a basket of physical equities and replicates the FTSE Gold Mines Net Tax Index, which currently represents 35 global gold mining companies that produce a minimum of 300,000 ounces of gold per year. Some of the countries represented in the ETF include Canada, US, South Africa, and Australia.

The Gold Miners ETF meets increasing investor demand for gold investing in light of a loss in confidence in paper money, caused by the increasing debt of developed countries, said Enhanced Investment Products (EIP), whose ETF business XIE Shares launched the ETF.

This debt, and recent political events such as Brexit and the US elections, point to more volatility and uncertainty in financial markets, and gold provides a hedge against inflation or deflation and is a store of value, EIP said in its statement.

“This new product…will enable retail and institutional investors to capitalise on gold price fluctuations through the ownership of gold mining stocks, which tend to go up and down more than the price of gold, given the size of their gold deposits relative to their market capitalisation. This year, gold mining stocks are outperforming physical gold by approximately 50%,” EIP’s ceo Tobias Bland said.

EIP is a Hong Kong-based investment management firm which was established in 2002. Brokerage and investment group CLSA acquired 49% of the XIE Shares Hong Kong ETF platform in 2014.

Net inflows into exchange traded products (ETP) have helped drive a sharp increase in gold investment demand this year, according to the World Gold Council (WGC).

Total gold investment demand rose 44% year-on-year to 336 tonnes in the third quarter of this year, with ETP inflows accounting for 146 tonnes as investors continued to build up their strategic allocations to gold, the WGC said in its report in November.

The spot gold price has risen around 30% since the beginning of this year to reach as high as $1,375.25 in July. The price has since pared to $1,205 per oz recently on Friday, but is still higher than the low of $1,062.40 reached at the beginning of this year. - See more at:

Samstag, 29. Oktober 2016

Big Picture: Goldminen-ETF GDX vs. 200-Tageslinie

Nachdem sich die Goldminen (GDX) im Zuge der spektakulären Rally bis zu 60% von der 200-Tageslinie entfernt hatten, wurde diese außergewöhnliche Konstellation in der jüngsten Korrektur komplett abgebaut:

Quelle: iShares, SPDR, Vanguard, Van Eck, GDX

Labels:

Agnico Eagle Mines,

AngloGold,

Barrick Gold,

Charttechnik,

Franco-Nevada,

GDX,

Goldaktien,

Goldcorp,

Goldminen,

Goldproduzenten,

HUI,

Kinross Gold,

Newmont Mining,

Randgold Resources,

Royal Gold,

Yamana Gold

Donnerstag, 27. Oktober 2016

Große Goldproduzenten legen solide Finanzergebnisse für das 3. Quartal 2016 vor

Die Zahlenflut ist da. Unter dem Strich ein ein ordentliches Quartal für die Gold Majors. Hierzu ein aktueller Bericht auf Mining Weekly:

Gold majors report upbeat Q3 earnings as costs continue to fall

27TH OCTOBER 2016

VANCOUVER (miningweekly.com) – The world's major gold producers on Wednesday reported mostly positive results for the three months ended September, saying profits increased while costs continued to fall in a higher gold price environment.

The world’s largest gold producer by output Barrick Gold reported adjusted earnings of $0.24 a share, compared with $0.11 a share in the comparable period last year. This beat analyst expectations of average earnings of $0.20 a share.

Revenue was down slightly at $2.3-billion from $2.32-billion a year earlier, while free cash flow fell to $674-million from $866-million.

Toronto-based Barrick increased its full-year 2016 production forecast to a range of 5.25-million to 5.55-million ounces of gold, from a previous target of 5-million to 5.5-million. Barrick has also lowered its estimate of all-in sustaining costs (AISC) to between $740/oz and $775/oz from a previous target of $750/oz to $790/oz.

The company added that capital expenditure for the current year was also lowered at between $1.2-billion and $1.3-billion, down from between $1.25-billion and $1.4-billion in the previous quarter.

Third-quarter gold output fell to 1.38-million ounces from 1.66-million ounces. AISC improved to $704/oz from $771/oz. Copper output fell to 100-million pounds from 140-million pounds.

Barrick reduced its debt load by $1.4-billion so far this year and the company said it was on track to meet its 2016 reduction target of $2-billion. In the medium term, it wants to reduce its $8.5-billion debt to below $5-billion.

NEWMONT DOUBLES DIVIDEND

Meanwhile, Greenwood Village, Colorado-based Newmont doubled its quarterly dividend to $0.05 from $0.025 previously. The company also refreshed its dividend policy, which is linked to the gold price. CEO Gary Goldberg stated that the revised policy had the potential to increase payout levels by more than 100%, starting in the first quarter of 2017..

27TH OCTOBER 2016

VANCOUVER (miningweekly.com) – The world's major gold producers on Wednesday reported mostly positive results for the three months ended September, saying profits increased while costs continued to fall in a higher gold price environment.

The world’s largest gold producer by output Barrick Gold reported adjusted earnings of $0.24 a share, compared with $0.11 a share in the comparable period last year. This beat analyst expectations of average earnings of $0.20 a share.

Revenue was down slightly at $2.3-billion from $2.32-billion a year earlier, while free cash flow fell to $674-million from $866-million.

Toronto-based Barrick increased its full-year 2016 production forecast to a range of 5.25-million to 5.55-million ounces of gold, from a previous target of 5-million to 5.5-million. Barrick has also lowered its estimate of all-in sustaining costs (AISC) to between $740/oz and $775/oz from a previous target of $750/oz to $790/oz.

The company added that capital expenditure for the current year was also lowered at between $1.2-billion and $1.3-billion, down from between $1.25-billion and $1.4-billion in the previous quarter.

Third-quarter gold output fell to 1.38-million ounces from 1.66-million ounces. AISC improved to $704/oz from $771/oz. Copper output fell to 100-million pounds from 140-million pounds.

Barrick reduced its debt load by $1.4-billion so far this year and the company said it was on track to meet its 2016 reduction target of $2-billion. In the medium term, it wants to reduce its $8.5-billion debt to below $5-billion.

NEWMONT DOUBLES DIVIDEND

Meanwhile, Greenwood Village, Colorado-based Newmont doubled its quarterly dividend to $0.05 from $0.025 previously. The company also refreshed its dividend policy, which is linked to the gold price. CEO Gary Goldberg stated that the revised policy had the potential to increase payout levels by more than 100%, starting in the first quarter of 2017..

Quelle: stockcharts.com

Freitag, 14. Oktober 2016

Dienstag, 11. Oktober 2016

Junior-Goldminen: Bullenmarkt im historischen Vergleich

Hierzu ein informatives und brandneues Chart-Update - credit to The Daily Gold:

Quelle: thedailygold.com

Sonntag, 9. Oktober 2016

Gold: Größter Wochen-Verlust seit Juni 2013, Goldminen auf Crashkurs

Der Goldpreis verliert in den letzten 5 Handelstagen mehr als 60 USD und verbucht damit die schwächste Handelswoche seit über 3 Jahren. Die Goldminen werden entsprechend auf Talfahrt geschickt..

Quelle: stockcharts.com

Quelle: stockcharts.com

Quelle: stockcharts.com

Donnerstag, 6. Oktober 2016

Führendes Goldminen-ETF GDX schließt Kurslücke

Labels:

AngloGold,

Barrick Gold,

Charts,

Charttechnik,

GDX,

Gold,

Goldaktien,

Goldcorp,

Goldminen,

Goldproduzenten,

HUI,

Kinross Gold,

Minenaktien,

Newmont Mining,

XAU

Samstag, 1. Oktober 2016

Rohstoff- und Minenbranche: Der Wochenrückblick von Haywood

Werfen Sie einen Blick in den informativen Wochen-Report von Haywood:

The Weekly Dig - September 30, 2016

Mick Carew, PhD and The Haywood Mining Team

Gold Volatility Continues as Investors Eye End of Year Fed Meeting

Highlights:

- Gold and gold equities continued their volatile run this week as investors adjusted to last week’s decision by the Federal Reserve to not raise interest rates, but keeping the door open for a rate hike before the end of the year. Since mid-August, the price of gold has fluctuated, rising as high as $1,351 per ounce on September 6 to as low as $1,305 per ounce on August 31st. Gold equities have followed suit, with the S&P/TSX Global Gold Index rising and falling twice between 230 and 250 in September. Gold ETF’s, including SPDR Gold Shares (GLD-NYSEARCA), also fell this week. It appears likely that this volatility will persist at least until the end of the year given the impending U.S. election in November and the possibility of a rate rise in November or December, and the question remains will gold remain above the $1,300 per ounce level. Gold (↓1.5%), along with silver (↓2.6%) and platinum (↓2.6%), were down this week, finishing at $1,317, $19.19 and $1,028 per ounce respectively. Palladium bucked the trend, finishing higher (↑2.6) at $721 per ounce. Base metals were mixed this week; copper continued to defy sceptical investors and was up slightly to finish at $2.21 per pound, nickel fell 1% to finish at $4.78 per pound, while both lead (↑10%) and zinc (↑5%) finished strongly this week, closing at $0.96 and $1.08 per pound respectively. The price of WTI crude rallied this week after news that OPEC agreed to limit supply to support low prices. This comes as Iraq boosted exports and Libya reopened some of its main terminals. WTI crude finished at $48 per barrel on Friday. Finally, the UxC Weekly Spot Price of uranium fell further (↓7.2%), finishing at $22.38 per pound on Friday.

Quelle: stockcharts.com

Quelle: stockcharts.com

Quelle: stockcharts.com

Labels:

Blei,

GDX,

GDXJ,

Gold,

Goldminen,

HUI,

Junior-Mining,

Kupfer,

Minenaktien,

Mining,

Nickel,

Öl,

Palladium,

Platin,

Rohstoffe,

Silber,

Uran,

Wochenrückblick,

Zink

50 Slides for the Gold Bulls: Update “In Gold We Trust” Report

Der Link zum informativen Chart Book Update: http://www.lumopolis.org/50%20Slides%20for%20the%20Gold%20Bulls%20-%20Incrementum%20Chartbook.pdf

Dazu das Feature auf Zerohedge:

Everything You Need To Know About Gold In 50 Stunning Slides

Submitted by Pater Tenebrarum via Acting-Man.com,

A Companion Update to this Year’s “In Gold We Trust” Report

Our good friends Ronnie Stoeferle and Mark Valek of Incrementum AG have just published a new chart book, which recaps and updates charts originally shown in this year’s 10th anniversary edition of the “In Gold We Trust” report and provides an overview of recent developments relevant to the gold market. The chart book can be downloaded in PDF form via the link at the end of this post..

Dazu das Feature auf Zerohedge:

Everything You Need To Know About Gold In 50 Stunning Slides

Submitted by Pater Tenebrarum via Acting-Man.com,

A Companion Update to this Year’s “In Gold We Trust” Report

Our good friends Ronnie Stoeferle and Mark Valek of Incrementum AG have just published a new chart book, which recaps and updates charts originally shown in this year’s 10th anniversary edition of the “In Gold We Trust” report and provides an overview of recent developments relevant to the gold market. The chart book can be downloaded in PDF form via the link at the end of this post..

Link: http://www.zerohedge.com/news/2016-09-30/everything-you-need-know-about-gold-50-stunning-slides

Quelle: http://www.incrementum.li

Quelle: http://www.incrementum.li

Labels:

Analyse,

Anlageklassen,

Big Picture,

Bullenmarkt,

Chart,

Edelmetalle,

GDX,

Geldpolitik,

GLD,

Gold,

Goldpreis,

In Gold We Trust,

Incrementum,

Inflation,

Notenbanken,

Performance,

Ronald Stöferle,

Update

Sonntag, 25. September 2016

USA, Finanzbranche: Top 10 ETFs nach Handelsvolumen

Das führende Goldminen-ETF GDX hat es im letzten Quartal sogar in die Top 5 geschafft. Daneben befinden sich das etablierte Gold-ETF GLD und das Energy-ETF XLE unter den Rohstoff-Investments in der ETF-Spitzengruppe..

Quelle: bloomberg.com

Labels:

Anlageklassen,

Einfluss,

ETF,

ETP,

Finanzbranche,

Fonds,

GDX,

GLD,

Goldminen,

Goldproduzenten,

Handel,

Handelsvolumen,

Investments,

Investoren,

Macht,

Rohstoffe,

Rohstoffmarkt,

SPDR,

Top 10,

XLE

Samstag, 24. September 2016

Rohstoff- und Minenbranche: Der Wochenrückblick von Haywood

Hier finden Sie den Wochen-Report von Haywood:

The Weekly Dig

Haywood Mining Team

Investors Sceptical on Copper as Red Metal Hits $2.20/lb

While the Federal Reserve announced its decision to hold interest rates (as expected) given continued weak economic data out of the U.S., the price of copper has defied the bears in September, rising from just above $2.00 per pound on September 1 through the $2.20 per pound level on Friday. Many commentators remain unconvinced that better times are ahead for copper, with the red metal commonly viewed as a useful guide to the state of the global economy. Certainly the Federal Reserve’s decision to hold rates could be seen as supporting this view, although some would view the Feds decision to keep interest rates on hold as more to do with timing given the impending U.S. election; in a statement released on Wednesday the Federal Reserve hinted at a possible rate hike this year, most likely in December, which may provide upward momentum for copper and other base metals in the medium term.

Meanwhile, after testing the $1,300 per ounce level last week, the Feds decision saw the price of gold rise 2% following the announcement before finishing at $1,338 per ounce on Friday. Gold equities followed suit, with the S&P/TSX Global Gold Index rising 4% to finish at 64.9 on Friday. Silver (↑5%), platinum (↑3.7%) and palladium (↑4.3%) were all up, finishing at $19.70, $1,055 and $704 per ounce respectively. In base metals, nickel prices surged almost 9% this week, finishing at $4.82 per pound while lead (↓1.4%) and zinc (↑3%) each finished at $0.87 and $1.03 per pound respectively. The price of WTI crude regained some of its recent losses, up 2.6% to finish at $45. Finally, the UxC Weekly Spot Price of uranium was down (↓3.1%) closing at $24.12 per pound on Friday..

Quelle: stockcharts.com

Quelle: stockcharts.com

Freitag, 23. September 2016

Webcasts vom Denver Gold Forum 2016 in Colorado Springs

Alle Präsentationen sind nun online abrufbar: http://www.denvergoldforum.org/dgf16/archived-presentation-stream-2016/company-webcasts-alphabetical-2016/

Quelle: denvergoldforum.org

Labels:

Colorado,

Colorado Springs,

Denver,

Denver Gold Forum,

Event,

GDX,

Goldaktien,

Goldproduzenten,

HUI,

Minen-Konferenz,

Minenaktien,

Qualität,

Silberaktien,

Silberproduzenten,

weltklasse,

WGC,

XAU

Barrick Gold: Präsentation auf dem Denver Gold Forum

Der Präsident Kelvin Dushnisky vom weltgrößten Goldproduzent Barrick Gold (ABX) hielt einen informativen Vortrag auf dem renommierten Denver Gold Forum: http://www.denvergoldforum.org/dgf16/company-webcast/ABX:US/

Und hier das gesamte, detaillierte Transkript zum Vortrag:

Barrick Gold's (ABX) Management Presents at Denver Gold Forum Conference (Transcript)

Und hier das gesamte, detaillierte Transkript zum Vortrag:

Barrick Gold's (ABX) Management Presents at Denver Gold Forum Conference (Transcript)

Quelle: stockcharts.com

Donnerstag, 22. September 2016

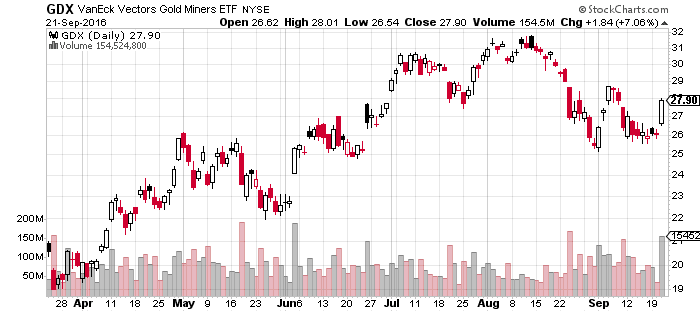

Nach FED-Sitzung: Goldminen explodieren unter hohem Handelsvolumen

Das führende Goldminen-ETF GDX drehte gestern frei nach oben und katapultierte die Aktienkurse der Goldproduzenten in die Höhe. Im Schnitt legten die Goldminen um mehr als 7% an Wert zu, was zu einem der besten Handelstage in den letzten Monaten führte. Das Fundament für die nächste Rallye-Stufe ist gelegt..

Quelle: stockcharts.com

Quelle: stockcharts.com

Quelle: stockcharts.com

Mittwoch, 21. September 2016

Goldproduzent Newmont Mining visiert Fortsetzung des Wachstumsplans an

Der nach Börsenwert nun wertvollste Goldproduzent der Welt, Newmont Mining (NEM), stellt weitere Wachstums- und Expansionspläne in Aussicht. Newmont gilt auch als Favorit für den Erwerb von weiteren Goldminen (u.a. Kalgoorlie Mine) vom aktuell noch größten Goldproduzenten (bzgl. Produktionsvolumen) Barrick Gold (ABX)..

Newmont's aggressive expansion plans

Newmont Mining is on an aggressive investment (and divestment) program which could see it catapult the company to the top of gold production stakes.

In a presentation at the Gold Forum in the city, Denver-based Newmont outlined projects that will add around 1 million ounces of gold to its portfolio and do so as soon as the middle of next year..

Link: http://www.mining.com/newmonts-aggressive-expansion-plans/?utm_source=twitterfeed&utm_medium=twitter

Newmont's aggressive expansion plans

Newmont Mining is on an aggressive investment (and divestment) program which could see it catapult the company to the top of gold production stakes.

In a presentation at the Gold Forum in the city, Denver-based Newmont outlined projects that will add around 1 million ounces of gold to its portfolio and do so as soon as the middle of next year..

Quelle: stockcharts.com

Labels:

Assets,

Ausblick,

Barrick Gold,

Big Player,

Branchengiganten,

Expansion,

GDX,

Goldaktien,

Goldminen,

Goldproduzenten,

HUI,

Minen,

Minenaktien,

Newmont Mining,

Wachstum,

XAU

Montag, 19. September 2016

Große Goldproduzenten fokussieren sich auf aktive Minenbezirke und Junior-Firmen

Hierzu ein aktueller Bericht von Reuters:

World's gold miners stick close to home in hunt for more metal

By Susan Taylor and Nicole Mordant | TORONTO/DENVER

The world's biggest gold miners are taking a cautious approach in their hunt for bullion, spending more money to explore around existing mines rather than new territory in a strategy that may have short-term gains but risks future production growth.

Top producers are relying more than ever on small companies to do the heavy lifting of searching for new deposits and increasingly taking 10 to 20 percent equity stakes in the junior miners.

Exploring close to home is more cost efficient and improves the odds of discoveries. But the chances of making major new finds are limited, diminishing global gold output, which is expected to decline by nearly 9 percent in the next three years.

"It only makes sense to be looking in your own backyard first before exploring elsewhere," said Paul Rollinson, Chief Executive of Kinross Gold, which spends about 90 percent of its exploration budget around existing sites.

"We focus on areas we already know, with existing infrastructure nearby, in jurisdictions we are comfortable with."

The world's 10 biggest gold miners are bumping up the share of exploration budgets earmarked for land around existing mines, or brownfield exploration, increasing the spending to 56 percent in 2015 from 45 percent in 2013..

World's gold miners stick close to home in hunt for more metal

By Susan Taylor and Nicole Mordant | TORONTO/DENVER

The world's biggest gold miners are taking a cautious approach in their hunt for bullion, spending more money to explore around existing mines rather than new territory in a strategy that may have short-term gains but risks future production growth.

Top producers are relying more than ever on small companies to do the heavy lifting of searching for new deposits and increasingly taking 10 to 20 percent equity stakes in the junior miners.

Exploring close to home is more cost efficient and improves the odds of discoveries. But the chances of making major new finds are limited, diminishing global gold output, which is expected to decline by nearly 9 percent in the next three years.

"It only makes sense to be looking in your own backyard first before exploring elsewhere," said Paul Rollinson, Chief Executive of Kinross Gold, which spends about 90 percent of its exploration budget around existing sites.

"We focus on areas we already know, with existing infrastructure nearby, in jurisdictions we are comfortable with."

The world's 10 biggest gold miners are bumping up the share of exploration budgets earmarked for land around existing mines, or brownfield exploration, increasing the spending to 56 percent in 2015 from 45 percent in 2013..

Quelle: stockcharts.com

Quelle: stockcharts.com

Labels:

Aktivitäten,

AngloGold,

Barrick Gold,

Exploration,

GDX,

Gold,

Goldaktien,

Goldcord,

Goldminen,

Goldproduzenten,

HUI,

Investments,

Junior-Mining,

Kinross Gold,

Minenbezirk,

Newmont Mining,

Projektentwicklung,

XAU

Abonnieren

Posts (Atom)